What’s Your Retirement Number?

What’s your retirement number?

Probably the first question to ask is not “What’s your retirement number” but “what is a retirement number?”

What is a Retirement Number?

One of the most important questions you can ask in your personal financial planning is “How much income do I need in retirement?” This is a question I used to ask a lot of my clients when I worked as a financial planner and very few of them could answer this with any degree of confidence. The main reason for this was that most of them had no idea what their current income and expenses were, let alone being able to anticipate what they may need to live on in a retirement that seemed so far away.

The follow-up question is “When do you think you’ll retire?”

The answers to both these questions will help you determine how much money you’ll need at that point in time to have a high degree of confidence that you will be able to fund your living costs for the rest of your life.

This figure is your retirement number.

Factors Affecting Your Retirement Number

You need to have a reasonable idea of what your living costs will be in retirement and also when you’ll retire. In addition, you need to think about how your money will be invested i.e. how much in shares, property, cash etc.

Here in Australia, we have a good social security system that provides an Age Pension to many Australians. Because of this, there are varying ideas around how much someone needs to save for retirement, because it is assumed that the Age Pension will cover some of your living costs, therefore you only need to have enough money from your retirement fund to bridge the gap.

Personally, I don’t want to assume that the current social security system will remain the same for the time up to, and throughout my retirement. I don’t trust either political party and I’m also well aware of the implications of an aging population and a reduction in the number of taxpayers to support the pensioners. Relying on an Age Pension for a portion of my retirement income is too big a risk for me. I don’t want to get close to retirement and then see the rules change to my detriment, and not have enough time to save more money.

So when I’m working out my retirement number, I ignore any potential government benefits. Yes, it means I need to have more capital saved up, but that’s a burden I’m prepared to have in exchange for greater security in my future years.

So let’s assume your money is invested in a balanced portfolio with around 60-70% in growth investments (shares and property) and the other 30-40% in cash and fixed interest. This type of portfolio will return around 5-7%, on average over the long term. Some years less, some years more, but over a rolling 7-10-year period you should expect this sort of return. This expected rate of return makes up one of our assumptions for your retirement number.

Next up, we look at draw-downs, and particularly your views around how much income you’ll need, and whether you’re comfortable drawing on your capital.

In my experience, most retirees are happy drawing-down on their capital over the course of their lifetimes. They don’t want to run out of money before they die, but they don’t want to have half a million dollars unspent in a bank account either.

As a friend of mine once said – “the first cheque that bounces should be the one to your undertaker.”

Your philosophy around drawing on your capital will affect your retirement number. If you don’t want to use up any capital and instead just want to live on the income your portfolio generates, you’ll need a bigger lump sum of money.

I’m always wary of rules of thumb when it comes to financial planning, but in this case, we’ll use one! A simple rule of thumb for retirement planning is to assume a 5% drawdown on capital as a safe withdrawal rate.

What this means is in the first year, you withdraw an amount equal to 5% of your investment. So if you had $1m, 5% would be $50,000.

The next year, your living costs probably increased a little bit because of inflation. We know that the cost of goods increases over time – another variable you need to consider when calculating your retirement number.

In this example, we assume a 2% inflation rate. So $50,000 + 2% = $51,000 (2% of $50,000 is $1,000. This then gets added to the initial $50,000 to give $51,000 – your desired level of income in the second year).

So how much capital do you have at this point? Let’s assume that you withdraw the initial $50,000 at the start of the year. In reality, you’d probably take it out over twelve monthly instalments, but for the purpose of this example (and my math skills) let’s keep it simple.

Taking $50,000 from your original $1m gives you $950k. Assuming this earns 6%, that would be $57,000. So your capital at the end of the first year would be $950,000 + $57,000 = $1,007,000.

From this amount, you draw your income for the second year of $51,000. So your capital drops to $956,000 for the year and you live off $51,000. Assuming the same 6% return, your capital would earn $57,360 over the year, which would give you a lump sum at the end of the year of $1,013,360.

Looking at this example, you’ve probably noticed that your capital is actually increasing in value. That’s correct. But a fatal flaw in financial planning is assuming that recent behaviour will remain the same over the long term. It doesn’t.

After a while, because of inflation, you’ll actually draw more money from your investment than what it made over the course of that year. So while your capital starts of increasing (usually over the first decade of retirement), it reaches a point where it will decline.

As we mentioned earlier, the key is to make sure your money doesn’t run out before you do.

Which brings us on to another variable – your life expectancy.

When will you die? I don’t think anyone can ever give a definitive answer to this question. Because of this, many retirement calculators make flawed assumptions.

Most calculators will use government-supplied life expectancy tables. There’s nothing wrong with this, but you need to understand what they mean, and what they don’t mean.

Currently, in Australia, a male aged 65 has a life expectancy of 19.2 years, meaning they’re expected to live to age 84.2. For females of the same age, your life expectancy is 22.05 year, so you’re expected to live to age 87. These are just averages. It means that of all the males currently aged 65, half will die before age 84.2 and a half will live longer. So if you base your retirement calculations on an average life expectancy (as most online calculators do), you have a 50% chance of outliving your money because you may (hopefully) end up in the group that lives longer.

How much longer? This is another unknown. My rule of thumb is to take the average life expectancy and add ten years to it. So if you’re a male aged 65, base your calculations on living to around 94. If you’re a female of the same age, use age 97.

This is the logic behind a 5% draw-down rate. it’s designed to slowly reduce your capital to zero, but over a longer period of time – around 25-30 years so you have more confidence in your money lasting as long as it needs to.

If you’re planning on retiring at 50 and think you’ll live to 100 you’ll need to base your numbers on a lower drawdown rate or else you run the risk of running out of money in your late 70’s or early 80’s.

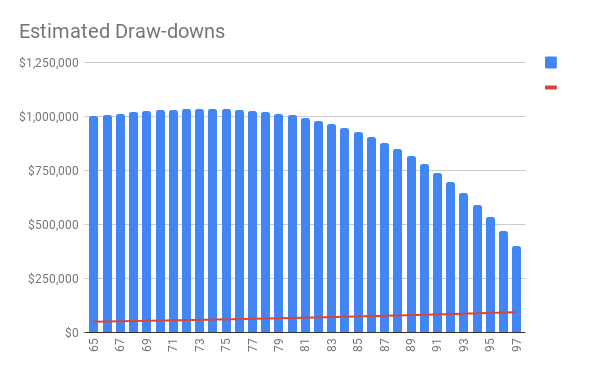

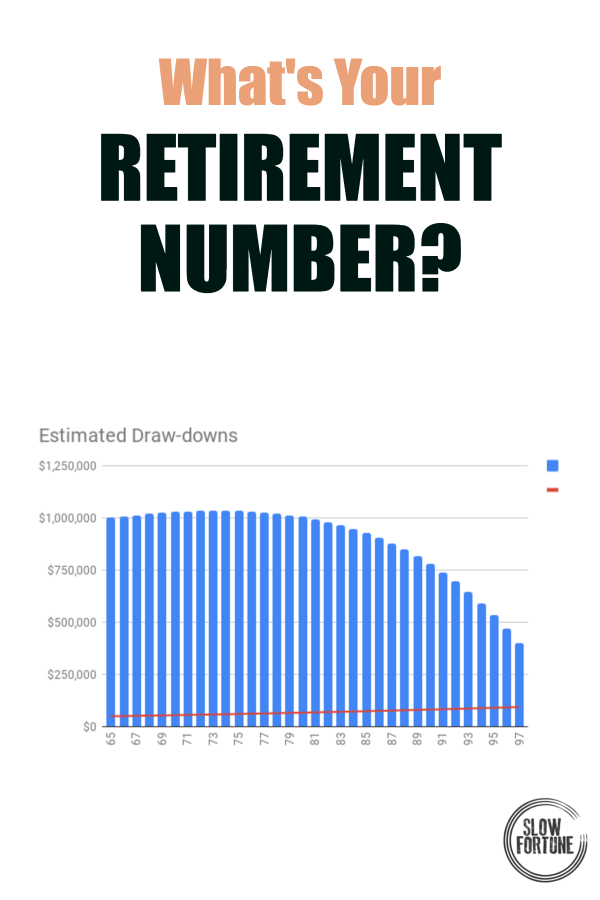

The graph below is based on a starting balance of $1,000,000 earning an average of 6% per year with an initial draw-down of 5% ($50,000) indexed to inflation (2%). You can see how the capital increases over the first ten years, then gradually decreases over time. However, after 33 years, there is still a small amount of capital remaining.

Estimated draw-downs. Initial capital $1,000,000

Earning rate 6%

Inflation 2%

Draw-down rate 5%

The reality is that this example will never actually happen because you won’t earn exactly 6% every year. Some years you’ll earn more, some years less but we estimate that, over the long term, an average return of 6% is realistic. The variable returns are an example of sequencing risk – something that’s outside the scope of this article but is important to understand. Put simply, the order of returns matter. If your first few years in retirement have negative returns, your money will run out sooner than if you have positive returns. This highlights the importance of regular reviews.

How To Calculate Your Retirement Number

I hope you can see that this is an imprecise art! There are so many variables that affect your calculations that it is impossible to have 100% confidence in your number. But erring on the side of caution will give you a greater chance of success. As will reviewing things along the way.

I hope you can see that this is an imprecise art! There are so many variables that affect your calculations that it is impossible to have 100% confidence in your number. But erring on the side of caution will give you a greater chance of success. As will reviewing things along the way.

Assuming you’re comfortable with the variables above, base your calculations on a 5% drawdown. So for every $100,000 you have saved up, it will provide approximately $5,000 income per year.

$1,000,000 will give you an income of approximately $50,000 per year.

$1,500,000 will give you an income of approximately $75,000 per year.

$2,000,000 will give you an income of approximately $100,000 per year.

If you’re more conservative, a 4% drawdown rate is a safe way to calculate your retirement number.

If you’re an aggressive investor who is confident in receiving higher returns over the course of retirement, a 6% or 7% draw-down rate may be more suitable.

Remember, this example also assumes you’re comfortable with your capital depleting over the course of your retirement. If you prefer to not touch any capital and just live off the income, things get a little more complicated.

For a growth-oriented portfolio i.e. primarily dividend-paying shares, you could base your calculations on a 4% draw-down, assuming total returns of around 7-8% per year. If you weren’t comfortable with that type of portfolio and were more conservative, then a 2% or 3% rate may be better.

But be aware of the implications of this. If you wanted an income of $100,000 and invested in a conservative portfolio and drew at a rate of 2% of the balance, you’d need a lump sum of around $5,000,000. If you were in a balanced portfolio and were comfortable receiving $100,000 a year while slowly depleting your capital, you’d only need around $2,000,000.

Your Retirement Number

I hope you can see that there are many variables in calculating your retirement number.

There are two key points here to remember:

- It is possible to estimate your retirement number. Once you have an idea of what the number is, you can begin to plan around how to get to it.

- The most important thing is to review it regularly. Investment returns change, so does inflation, so does your cost of living and so does your health. Your number will change over time and that’s to be expected.

I hope this article helps you understand the different factors that combine together to help you calculate your retirement number. It’s different for everyone which is why I always suggest you take the time to work out what’s right for you, rather than rely on something you read in the paper or in an investing magazine.

I’d love your thoughts. Do you have questions around your retirement number? Or have other thoughts around this topic?

Leave a comment below.

Download your FREE report - 5 Money Mistakes You Don't Realise You're Making

These money mistakes are costing you money and you probably don't even know you're making them.

0 Comments