The Barefoot Investor For Families – Book Review

The new Barefoot Investor book is out – the Barefoot Investor For Families – and my copy arrived a couple of days ago. I’ve been waiting to see what advice Scott Pape has to help educate kids about money and he doesn’t disappoint with this book.

If you’re a parent wondering how to teach your kids about money, this book is for you.

The first section is all about first steps – some fundamentals of helping your kids take their first financial steps. Once you’ve covered that part off you move onto what Scott calls “The Barefoot Ten” – a series of ten money skills that your kids need to learn before they leave home. The book finishes with part three – Off and Running where he shows you a very unusual (but cool) way to celebrate your child’s new-found financial knowledge.

How Does The Barefoot Investor For Families Work?

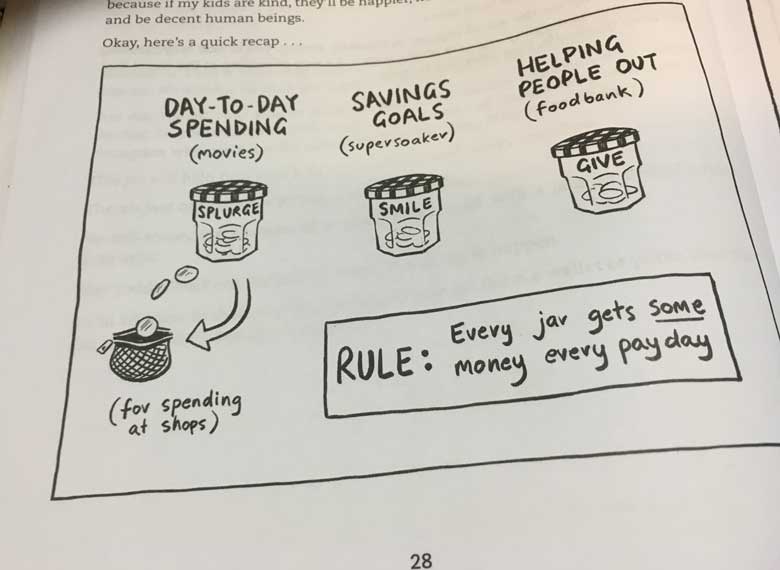

When you look at the Barefoot system for adults, it involves multiple bank accounts. For kids, it involves three jam jars. Yes, jam jars. Actually, any jars will do, but Scott loves his jam jars.

The concept is simple. Jam jars are the new buckets. In the adult version, each bank account represents a different bucket of money. In the kid’s version, each jam jar represents a bucket.

One is a Splurge jar, one a Smile jar and one the Give jar. The Splurge jar is for everyday spending. The Smile jar is for your savings – your kids can save up for things that make them smile. The point of this jar is to teach your kids how to save, and the benefits of savings. The Give jar is to be used to help other people – the Barefoot Investor is a big believer in teaching your children that giving and helping other people is important. The Give jar is part of this, as is volunteering to help those less fortunate.

Scott doesn’t recommend a set amount into either of the three jars – he just says that it’s up to your kids to decide with the one rule; each jar gets some money each payday.

The Barefoot Investor Jam Jars – the kids version of multiple bank accounts

Next, Scott introduces us to the idea of Three Jobs. The idea is that your kids have three jobs to do each week and only get pocket money if they complete the three jobs. If they’re not completed, there’s no pocket money.

Finally, there’s the concept of Three Minutes. This is the time of the week where your kids get their pocket money. The Barefoot way is to have coins ready for your kids and then they allocate them to the Three Jam Jars. There’s a real benefit in making the money tangible and not just putting it into a bank account for them.

So at a base level, there are the three things to remember:

- Three Jam Jars

- Three Jobs

- Three Minutes

It’s a simple thing to set up and the book explains how to present the concept to your kids and there are even pre-built templates to help you chart the completion of the three jobs.

Next up, the Barefoot Investor for Families moves into the Barefoot Ten.

The Barefoot Ten

The Barefoot Ten is a process your kids go through to learn some valuable money skills. Once they finish it, they will have:

- Opened a zero-fee, high-interest savings account

- Bought and sold something second-hand

- Learned to cook at least two low-cost delicious nutritious meals from scratch

- Volunteered in their local community

- Saved you at least $100 on your household bills

- Promised to never, ever get a credit card

- Got a part-time job from age 15

- Earned at least one glowing reference from a boss

- Opened up an ultra-low-cost, high-growth super fund

- Set up a savings account for a home deposit

I’m not going to go into each step in detail, because that’s what the book is for. Suffice to say that each step has its own chapter and instructions on how to present this to your child. There’s nothing too difficult in here and it’s all part of teaching your kids valuable life (and money) skills that they’ll need to be independent.

My youngest son is reading through the book and has read the chapter on how to get a part-time job. There’s even a Barefoot Investor resume template you can download to create your first resume. I suspect a lot of fast food companies and supermarkets will be seeing a lot of these resumes as more families use them.

I enjoyed the chapters and the lessons Scott is trying to teach. There’s a lot of information, but it’s laid out well and it’s easy to follow. The idea is that you have ten Money Meals with your kids over a ten-week period and go through one step per meal. It’s interactive and there are steps that your children need to do – this is part of empowering them with money. If you’re not convinced, check out the story of the family from step 5.

Again, Scott explains how to present each concept to your children and provides the outlines and all the tools you need. This isn’t hard to do and as I was reading through I was impressed about how easy he’s made it for you to have these conversations with your kids.

The Barefoot Ten – not just for kids

My Thoughts On The Barefoot Investor For Families

I’m glad a book like this exists. Most people will openly admit that they don’t manage their money as well as they could and they wish someone had taught them valuable money lessons when they were younger.

That’s why this book exists.

To provide mums and dads with the knowledge, skills, and tools to teach their kids about money. Because if you don’t do it, they’ll learn from other places. And I don’t want my kids learning about money from a bank. Particularly a bank that wants to offer them a credit card at age 18.

The book provides a roadmap for you to teach your kids about money and life.

My kids are 17 and 14 – a bit older than Scott’s kids, so some of the concepts are amended for older kids. Pay from work goes into bank accounts and money is allocated into a high-interest savings account. I’m working out how we’ll amend some of the system to make it work for our kids. But the main parts will remain because it works.

The day the book arrived one of my sons started reading it and he was amazed (not in a good way) that ‘normal’ is $4,200 in credit card debt. And it would take 42 years to repay this debt if you only made the minimum payment. Fantastic, you’ve now got the attention of a 14-year-old kid.

And that’s an important point – Scott has a great writing style that is easy to follow and almost like you’re sitting across the table from him having a conversation. As an adult, I find it easy to follow and my teenage kids have no problems understanding what he’s talking about. It’s worthwhile adding here that the book is not specifically meant for kids to read. The idea is that you read it, download the relevant templates etc and have a series of Money Meals with your family and talk about money. The Money Meals are the kid version of the Barefoot Date Nights.

Another good thing is that the book has a series of testimonials throughout from families who have worked through some of the concepts in the book This is a great way of demonstrating the diverse range of families who are going through the Barefoot Investor for Families steps. If they can do it, you can do it.

I’ve worked for years in the financial planning industry and one of the things our industry doesn’t do well is provide financial education for kids. And now that my eldest son is in his final year of high school I can tell you that schools don’t provide much financial education that’s relevant. Sure he can calculate simple interest on a home loan, but no one’s explained to them how credit cards work and how to select a mobile phone plan. This book is practical and has the potential to change young lives by teaching them some basic financial principles.

Should I Buy The Barefoot Investor for Families

To quote a famous Australian who you’re probably familiar with – do yourself a favour and buy this book.

Most Australians suck at managing their money. Don’t set your kids up to fail. This book will show you how to talk about money with your kids and equip them with the knowledge they need to get ahead financially. And you may learn something yourself as well.

In fact, if you haven’t already done so, get a copy of the original Barefoot Investor book for yourself at the same time as buying the Barefoot Investor For Families.

You can grab a copy online at Book Depository or you can go into your local bookshop. At the time of writing it looks like the book will retail for around $29.99. You may be able to find it cheaper at stores like Target or Big W – they have the Barefoot Investor book (the original) for around $19 usually.

Don’t think about this as a cost – it’s an investment. An investment in your kid’s future and it’s way cheaper than school fees.

For the price of one Macca’s meal, you can get a book that puts your kids on the right track. And will probably save you many Macca’s meals over the long term as your kids (and you) develop better money habits. That’s got to be a good thing!

I’ll write some follow-up articles as our family goes through some of these steps. so you can see how we’re going.

What do you think? Have you bought the book already? Did you like it? Do you have questions?

Leave a comment below and let me know.

Download your FREE report - 5 Money Mistakes You Don't Realise You're Making

These money mistakes are costing you money and you probably don't even know you're making them.

0 Comments