Debt Avalanche – Pay Off Your Debts Sooner

Have you heard about a method of reducing debts called the Debt Avalanche? It’s a very simple but effective way to help you reduce debt when you have multiple loans.

In this article, we’ll look at what the Debt Avalanche method is, how it works and you’ll learn how to set up your own Debt Avalanche strategy to reduce your debts.

How To Reduce Debt

When it comes to reducing debt or repaying a debt sooner, there are really only two options – pay more money off the loan or reduce the interest rate.

The Debt Avalanche strategy focuses on the first option – paying more money off your loans.

How the Debt Avalanche Works

The strategy is simple. You make the minimum payment on all your debts except one – the one with the highest interest rate. Not the highest balance – the highest interest rate.

The reasoning is simple – this debt is costing you the most money.

It may not be your biggest debt, and the actual amount of money you pay in interest may not be as high as you pay on some of your other loans, but it’s costing you the most because of the high rate of interest.

So get rid of it.

Direct all your extra payments across to this debt. If you were paying extra off your other loans, reduce those repayments down to the minimum amount and direct the surplus money to that debt with the highest rate of interest.

Your short-term goal is to repay this debt as soon as possible.

Once it’s repaid, you move on to the debt with the next-highest rate of interest. All that money you were paying of the first debt now gets directed to this debt plus there’s the amount you were already paying off this debt which continues to go to it.

Eventually, you’ll repay this debt and can move on to the next one. Now you take all that money you were repaying off this debt and direct it to the loan with the next-highest rate of interest.

And so on and so on until you get rid of all of it.

Why Does The Debt Avalanche Work?

The Debt Avalanche strategy works well because it forces you to focus on the portion of debt that has the highest interest rate and you develop a strategy that makes good financial sense to repay it.

Being able to focus on one debt at a time (with the highest rate of interest) is important because it gives you a very distinct purpose around what you’re aiming to do. As you concentrate all your extra repayments towards this loan, you’ll also see a tangible drop in the loan balance which will make you feel like you’re actually getting somewhere.

The other reason it works so well is to do with how you’re allocating your money.

If you weren’t using the Debt Avalanche system, you’d repay off one of your debts and then probably just start spending the money you were previously repaying off the loan. You wouldn’t allocate it towards your other debts.

You’d spend it.

And then you’d take longer to repay your other loans and pay more in interest in the process.

Why Don’t I Just Focus On The Smallest Debt First?

This is a question I get asked a lot by people and it makes sense – why wouldn’t you repay the smallest debt first. This strategy, made popular by Dave Ramsay, has been called the Debt Domino strategy or the Debt Snowball Strategy and is similar to Debt Avalanche in terms of how the repayments cascade across the loans once each one is repaid. The difference is that the order is determined by the size of the debt, not the rate of interest being charged.

The advantage of doing this is that you can feel like you’re making quick progress because you’ve managed to repay one debt.

The problem is that even though this was a small debt, you’re being charged a greater amount of interest on other debts that you hold. So over the long term, you’ll pay more money in interest.

This can still be a relevant strategy though if it’s the best way to motivate you to do something.

Even though you’ll pay more in interest, if you feel like you wouldn’t be motivated with the debt avalanche system, then the debt domino system can be an adequate Plan B for you and you’ll still repay your debts sooner, just not as quickly as you would with the Debt Avalanche.

The field of behavioural economics studies how our brains affect our money decisions and there have been numerous studies on debt reduction strategies. Many of them show that people are more motivated when we can see quick wins, so the idea of paying the loan with the smallest balance first makes a lot of sense with this in mind. Even though you’ll pay a little more over the longer term, the alternative of the Debt Avalanche may just not motivate you enough to the point where you no longer follow it.

In that case, you’re better off following a debt reduction strategy like the Debt Snowball rather than having no strategy at all.

Getting Started With Debt Avalanche

It’s very easy to set up your own Debt Avalanche strategy to repay your debt sooner. Just follow the steps below and you’ll be able to set up your very own Debt Avalanche plan.

What Are Your Loans?

Make a list of all your loans and include:

- How much you owe

- What the minimum repayments are

- What your current repayments are (may be different to the minimum)

- Interest rate

Setting Up The Debt Avalanche Strategy

Now that you’ve listed out your debts, sort them in order of interest rate, from highest to lowest.

Next, for all the debts other than the one with the highest interest rate, write down the minimum payment you can make. If you were paying extra to these loans before, make a record of the difference between the two payments.

Allocate all repayments towards the debt with the highest rate of interest. Apart from the money you are already paying off this loan, add the extra bit of repayments you were making off your other debts that are now being directed to this loan. You may also decide to make extra repayments by allocating more money from your overall budget towards this strategy.

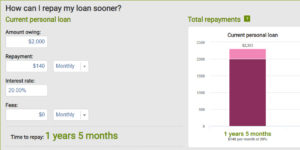

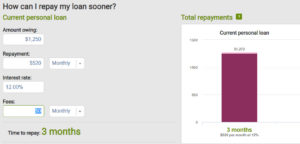

You can use a calculator like this to see how the Debt Avalanche strategy can work for you. It’s also a good thing to print out the calculations and display them somewhere where you’ll see them regularly and they’ll keep you motivated. Every month as you make progress, cross off those lines on the print out so you can see how you’re going.

Once that first debt is out the way start on the debt with the next highest interest rate.

And do something about that first debt to make sure it doesn’t happen again. Most commonly, if it’s a credit card or store account, cancel the card if you can so you’re no longer tempted to use it. If it’s something like a medical bill, start allocating a bit extra in your budget towards extra bills, so next time something like this happens you’ll have some financial reserves.

Debt Avalanche Example

Here’s an example of the Debt Avalanche in action.

Julie has three loans she wants to repay using Debt Avalanche:

- A credit card with a balance of $8,000, an interest rate of 18% and a minimum monthly repayment of $160.

- A store account with a balance of $2,000, interest rate of 20% and a minimum monthly repayment of $40.

- Car loan with a balance of $9,000, interest rate of 12% and a minimum monthly repayment of $220.

In addition to these total repayments of $420 per month, she’s been paying an additional $100 per month off the car loan.

To set up the Debt Avalanche, she places the debt in order of interest rate, with the highest one first. So the order becomes:

- Store account $2,000 @ 20% pa

- Credit Card $8,000 @ 18% pa

- Car Loan $9,000 @ 12% pa

She pays the minimum monthly payments off the car loan and credit card, and directs the extra $100 per month to the store account, along with its monthly payment of $40. A total of $140 is being repaid off this debt.

Based on the balance of $2,000 she’ll have this debt repaid in around 17 months.

Once that debt is repaid Julie does a little happy dance and then directs that $140 payment to her credit card. Along with the minimum payment of $160 that she was already paying, this means she’s now paying $300 off the credit card. And the balance has reduced a little over that 17 months to $7,200.

Over the next 30 months, she makes steady progress and has now repaid that credit card. She invites her friends around for a card-cutting-up ceremony where she destroys the card and calls the credit card company and asks them to cancel it. She then celebrates with a drink with her friends (paid for in cash, of course).

Now she has one debt left.

She now has the $300 per month to pay off her car loan, as well as the $220 she’s already been paying. Also, the car loan debt has been steadily reducing each month because her $220 payment is covering interest and reducing principal so she now has a loan balance of around $1,250.

She has a total of $520 to direct towards the $1250 loan.

This one’s simple to work out – in under 3 months that car loan is repaid.

And she now has a spare $520 each month to save for her future goals.

You can see from this example how the avalanche effect is achieved – once one debt is repaid there’s now an even larger payment going to the next debt.

Is Debt Avalanche Right For Me?

If you have debt and the capacity to make more than the minimum payments, then the answer to this question is ‘yes’.

From a pure numbers perspective, this is the method that will save you the most interest. On the other hand, if you get more motivated by some quick wins and are worried that you may lose motivation, the Debt Snowball strategy may be a better option, provided you stay motivated and adhere to it. But over the long run, smashing the debts that cost you the most will be the most effective way to go.

And if you’re bothered about motivation, automate everything. I do. Once you’ve sorted out the repayment amounts, set up direct debits from your bank account to automatically make the payments for you. The less you need to do, the better. And if you know you have some fixed payments coming out your bank account, you’ll always make room for them.

What questions do you have about the debt avalanche method?

Have you used it to reduce debt?

Leave a comment below.

Download your FREE report - 5 Money Mistakes You Don't Realise You're Making

These money mistakes are costing you money and you probably don't even know you're making them.

0 Comments