A Simple Tip To Repay Your Home Loan Six Years Early

Most people I speak with in the Slow Fortune community who have a home loan would like to repay it sooner. There’s a bunch of strategies to do that, but here’s a simple idea that no-one else seems to be talking about. It’s all about using inflation to your advantage.

When you first take out a home loan, you’ve got a monthly repayment to make. If your loan term is 25 years, you make that same repayment for the next 25 years. And, assuming interest rates don’t change, you pay your loan off over that period of time.

But over time, due to inflation, your income will increase. You’ll receive pay rises over that 25-year loan term and if you change jobs, you’ll probably find yourself on a higher income. But your loan repayments don’t increase – they remain the same over the course of your loan and will only vary if interest rates change.

So here’s the simple hack that will help you repay your loan 6 years earlier.

Using Inflation To Repay Your Home Loan Faster

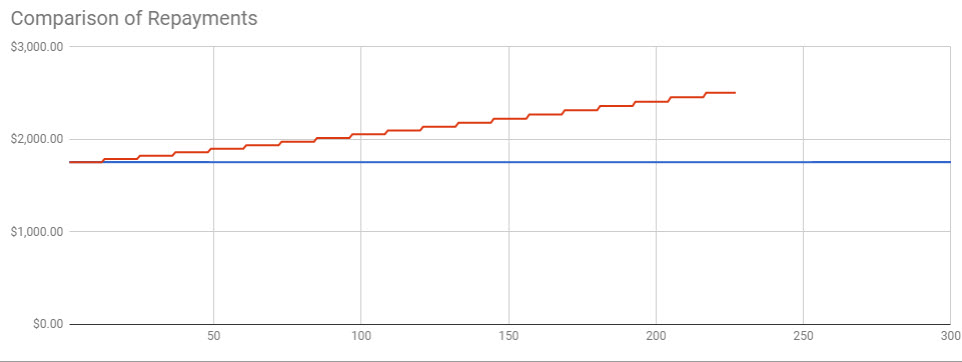

Instead of keeping your loan repayments at the same level for the term of the loan, you increase them in line with inflation.

Every year you increase your home loan repayments by the rate of inflation or the increase in your pay (if it’s higher). So if you were paying $1,000 a month off your home loan and inflation was 2%, you’d increase your repayments to $1,020 per month in the second year. In the third year, you’d increase your repayments to $1,040.40. It may not seem like much, but if you do this each year, it’ll add up. $20 per month is easy for most people to cope with, and may not seem like much, but the cumulative effect makes a massive difference over time.

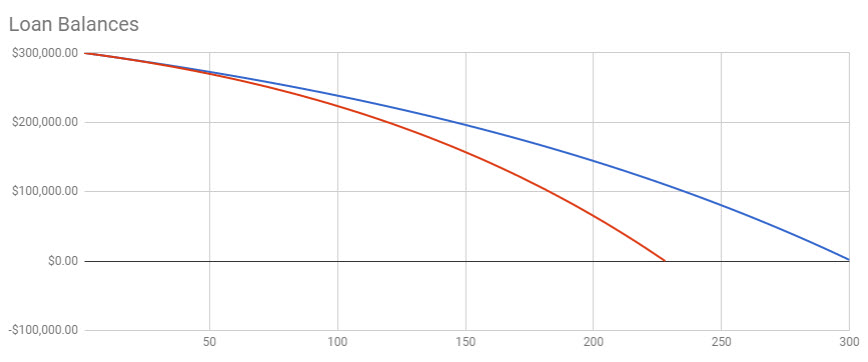

I’ve put together an example based on a $300,000 home loan with a 5% interest rate over a 25-year term and a minimum monthly repayment of $1,754.

If you paid the normal repayment every month, you’d repay the loan in 25 years and make total payments of $526,200. Of this, $300,000 is principal and $226,200 is interest.

If you elected to increase your repayments by 2% every year, you’d cut the loan term to 18 years and 11 months. Let’s call it 19 years – a full 6 years less than if you didn’t increase your repayments each year. And by reducing your loan term you’re reducing the amount of interest you have to pay to $178,243. That’s a saving of $47,957 in interest over the term of your loan ($226,200 – $178,243).

Imagine repaying your home loan 6 years early by simply increasing your repayments each year.

It’s a simple strategy and very easy to put in place. You won’t notice the extra repayment out of your income, and it’ll reduce the term of your loan.

Have a look at the image to see how the 2% increase each year adds up. You start off paying $1,754 per month and in the second year, a 2% increase raises this to $1,789 per month – an increase of $35 per month. The next year, it increases to $1,825 – a $36 increase. By the 18th year, you’re paying $2,505.14 per month – it’s an increase of $751.14 per month over your initial repayment. If I asked you to increase your loan repayments by $751 each month from the start, you’d probably find that hard, but you can see how easy it is to do my making small steps each year.

You can see how the small increase every year ends up making a big difference over the long term.

What if your income grows by more than inflation? Simple – increase your repayments by that rate. If you get a 5% raise, then increase your repayments by 5%.

When it comes to money, the little things can add up. This is just one way that you can make a substantial difference to your finances.

Of course, the banks don’t promote this – they want you to keep as much debt as possible with them so they’re not interested in helping you reduce it any quicker. That’s fine. At Slow Fortune, we know that the banks aren’t on your side.

Action :

Can you put this in place today? Arrange with your bank to increase your repayment by 2% and make a note next year (or when your salary gets reviewed) to increase it again. Remember, the small things add up.

Download your FREE report - 5 Money Mistakes You Don't Realise You're Making

These money mistakes are costing you money and you probably don't even know you're making them.

0 Comments