7 Things To Look At On Your Superannuation Statement – 2020

Most people don’t get excited when they receive their annual superannuation statement. That’s understandable because they don’t know what to look at on their superannuation statement.

In this article, we’ll talk about how to decipher your superannuation statement and understand the important elements.

Table of Contents

#1 Are your details correct?

The first thing to look at is whether your details shown on your statement are correct. Most super statements have your name and address at the top, and somewhere else you’ll find your date of birth. Make sure this information is correct.

If you’re receiving statements via email, make sure the street address is still correct. Make sure your name is spelt correctly and not shortened. This is very important because one day if you want to combine superannuation funds or make a withdrawal, they’ll want to verify your identity, and if your identification shows a different name than what the fund has on file, it will delay things until they can sort it out.

Check that your date of birth is correct – an incorrect DOB will mean that the fund will struggle to verify your identity AND you may find you’re paying the wrong rate on any insurance you may have.

Also make sure that the statement shows that the fund has your tax file number. It won’t show the actual number, but somewhere it will say whether they hold your TFN. This is important because in the event of your super becoming ‘lost’, a TFN is one of the easiest ways to recover your super.

#2 Have all your contributions been received by your superannuation fund?

The superannuation statement will list out all the transactions over the statement period. Make sure that if your employer is making contributions, every contribution has been accounted for.

Employers must make superannuation contributions every quarter, usually by the 28th day of the second month after the quarter. So for the October – December quarter, your SGC needs to be paid by the 28th of February.

Most employers pay more regularly than this – either monthly or fortnightly at the same time as they submit their payroll. There’s no reason for an employer to still be paying quarterly – it’s your money and you’d want it invested as soon as possible, not three or four months later. If your employer is paying quarterly, ask them if they’re able to pay more regularly. Whilst it’s not illegal to pay quarterly, with today’s electronic payroll systems, it’s actually very easy to pay monthly or fortnightly.

Contribution frequency is also important when it comes to any contributions you make via your payroll, particularly any salary sacrifice contributions you are making to your superannuation fund.

If you get paid fortnightly, you will see your super contributions on your payslip every fortnight. But your employer doesn’t have to actually bank these payments into your super fund until the dates we mentioned above. So just because you see the money deducted from your payslip, don’t assume it’s automatically deposited into your superannuation.

The quarterly lodgement dates described above also mean that at the start of the financial year you’re probably receiving contributions from the previous financial year, and the contributions for the April – June quarter may not be paid until the next financial year. This becomes an issue if you are close to the superannuation contribution cap of $25,000. In many cases, it evens out with the contributions from the final quarters being paid in the new year, but if you have a significant salary increase or decide to salary sacrifice more, it is important to know what contributions have been made to your superannuation fund for the financial year to date so you don’t exceed the contribution cap.

If you haven’t received all your contributions, this is a problem. Firstly, give your employer the benefit of the doubt and ask them where your contributions are. This is particularly relevant if you’ve received most payments but one has been missed.

If no contributions have been made, check your payslip to see where your contributions are going. I’ve known people to panic that their employer wasn’t paying anything into their superannuation fund only to check their payslip and realise it was going into a different fund.

If you only have one fund and there are no contributions, then it gets awkward. In situations like this, particularly when it’s a small business, people can be reluctant to chase up their missing super because they fear it could lead to them losing their jobs. A better option may be to report them directly to the ATO – the ATO will then contact your employer to chase up the missing contributions.

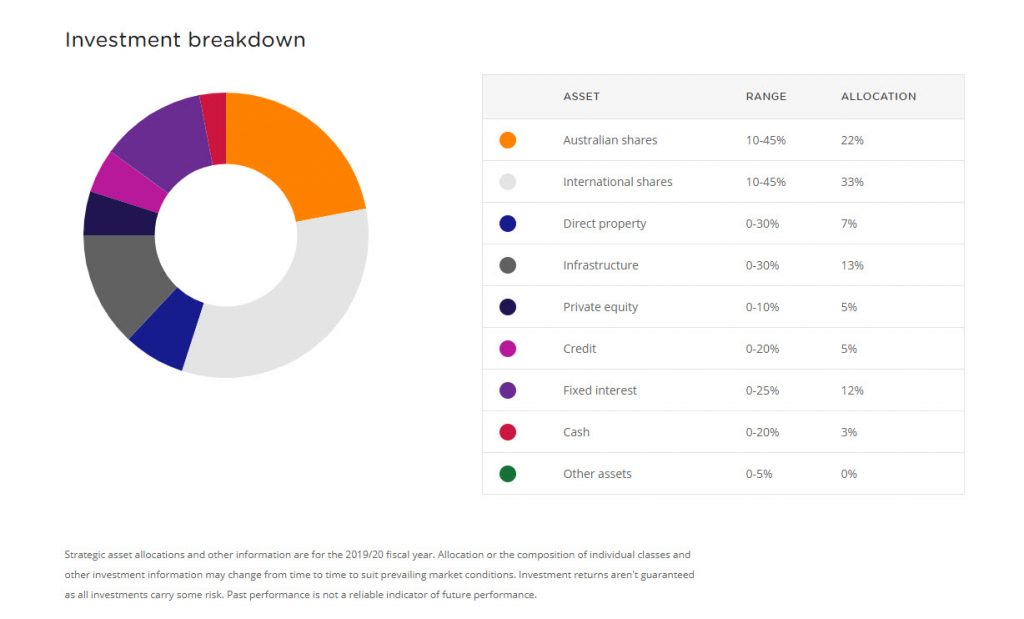

#3 Where is your superannuation money invested?

Within your superannuation fund, you’re likely to have a range of investment options ranging from conservative to aggressive. There are two things you should check on your statement:

- Which investment option (or options) is your money invested in?

- Which investment option (or options) are your contributions being directed to?

The correct superannuation investment option for you depends on a number of things and is outside the scope of this article. For now, be aware of how your superannuation funds are invested and consider whether changes are necessary.

#4 What insurance do you have inside your superannuation?

Most superannuation funds have a default level of insurance that is provided to members. Recent changes in legislation means that for lower balances and younger people, the default cover may not be provided – it becomes an opt-in scenario rather than having it automatically.

Have a look at the amount of life, total and permanent disability (TPD) and Income Protection insurance you may have in your fund.

The question of ‘how much cover is appropriate’ is a big question and we won’t attempt to answer it in this article, but you should have a think about your personal financial circumstances and whether you have enough (or too much) cover. Also, check with the fund to see how your cover may vary over time. A lot of super funds have cover that decreases as you get older. This isn’t necessarily a bad thing, but it’s important to be aware of it in case you lose cover that you actually needed.

#5 Who gets your super when you die?

You are able to nominate a beneficiary for your super fund. This person (or persons) gets your super when you die. In many cases, you’re able to set up a non-lapsing binding death nomination. This is still not 100% water-tight and can be challenged, but it’s the best option available to give you more certainty around who will receive your super when you die.

There are a couple of things to consider here.

Firstly, does your current nomination reflect your current wishes? A classic example that I’ve seen all too often is when there’s been a marriage breakup and the ex-wife or husband is still nominated as the beneficiary. Once I point this out to the client, there’s usually a string of profanities uttered together with a commitment to change it as soon as they can.

The other thing to consider is whether you should or should not have adult children nominated. If they’re non-dependant on you, there will likely be tax implications on any money paid to them via your superannuation as a death benefit. It’s worth getting advice on this.

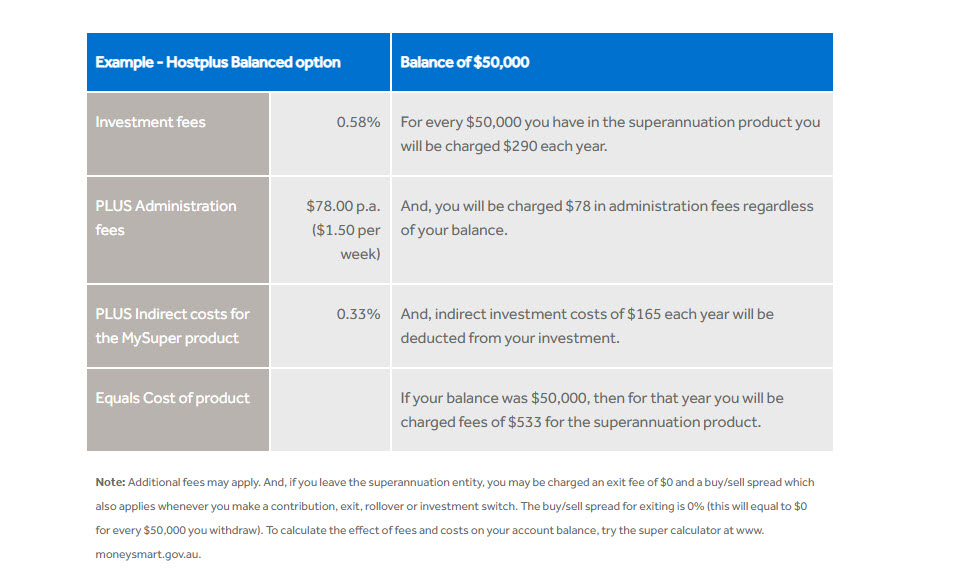

#6 What does your superannuation cost?

Your fees will be clearly disclosed in your statement. There is a lot of discussion in the financial planning world about the effect of fees on your returns, and your eventual retirement nest egg.

I don’t disagree that, if all other things are equal (i.e. gross investment returns), then a higher-fee fund will not be as good as a lower-fee fund. But things aren’t that simple and funds returns before fees are rarely the same.

So focussing on fees to the exclusion of everything else is a dangerous thing to do.

I’ll write another article on this so you can learn more about how to evaluate fees when looking at your super fund.

#7 Are you saving enough?

The harsh reality is that most Australians aren’t saving anywhere near enough for their retirement. And most are blissfully unaware.

Many super funds are now putting a projected balance in the member statements. This is an indication of what your super balance could be if you retire at age 67. Some funds will also show you how much income this could equate to.

Be aware that all the income projections I’ve seen include an Age Pension in them, and it’s likely that the Pension rules in Australia will change by the time you get to retirement.

But despite the faults around these figures, they can be helpful in motivating you to save more.

As part of this step, also have a look at your current super balance. Whilst focussing on short-term numbers is pointless when it comes to your long-term savings, it is important to understand how much you have in your super.

Things To Look At On Your Superannuation Statement – Summary

Now you will have a much better idea of what to look at on your superannuation statement and the importance of each item.

One thing I deliberately have not covered here is whether your current super fund is the best one for you. I’ll do another article on that as there is a lot to consider and I don’t want to confuse you with information overload.

Do you have any questions about things to look at on your superannuation statement? Leave a comment below and let me know.

Download your FREE report - 5 Money Mistakes You Don't Realise You're Making

These money mistakes are costing you money and you probably don't even know you're making them.

0 Comments